income tax rates 2022 ireland

Get a quote today. There are seven federal income tax rates in 2022.

Corporate Minimum Tax Could Hit These Profitable Companies The Washington Post

2022 EUR Tax at 20.

. Ad Compare Your 2022 Tax Bracket vs. This money has been accredited to changes to income tax bands that will enable. Income tax rates will stay the same at 20 and 40 but there will be increases to tax credits and changes to the income tax bands.

4 rows Rates and bands for the years 2018 to 2022. That you are an. Please note the results are approximate.

Ireland Personal Income Tax Rate was 48 in 2022. Ireland Annual Salary After Tax Calculator 2022. Ireland Personal Income Tax Rate - values historical data and charts - was last updated on May of 2022.

The Irish government announced in connection with Budget 2022 released October 12 a planned increase in the corporate tax rate to 15 in line. 2021 Rate 2022 Rate. Ad We file personal income tax returns for individuals across Ireland.

The rates of 20 and 40 will remain as they are but the standard tax rate band ie the amount you earn before paying the higher rate will increase by 1500. Ireland Personal Income Tax Rate was 48 in 2022. By Doug Connolly MNE Tax.

Income Tax Brackets 2022 Ireland. A high quality low cost Irish tax return service from just 185. Aggregate income for the year is 60000 or less.

The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your. In 2022 for a single person with an income of 25000 the effective tax rate. Use our interactive calculator to help you estimate your tax position for the year ahead.

Listed below are the current VAT rates in Ireland in 2022. Workers on this rate will notice an increase in the money they take home. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

Tax Rates and Credits 2022 Value Added Tax changed Standard ratelower rate 23135 Hospitality and tourism newspapers electronically supplied publi-cations and sporting. Single and widowed person. The mid-range rate of 2 now applies to a greater proportion of income as of January 1 2022.

Discover Helpful Information and Resources on Taxes From AARP. Tax Bracket yearly earnings Tax Rate 0 - 36400. There were no changes.

Get a quote today. If the corporation distributes those earnings as a dividend the income is taxed again at. Ad We file personal income tax returns for individuals across Ireland.

The standard rate tax band the amount you. Variations can arise due to rounding. The rates of Car Tax in Ireland have not been changed for a few years but in Budget 2021 there were some adjustments to motor tax on some cars.

The Budget 2022 package includes approximate 520m in tax cuts. 8 rows PAYE earners. These rates of VAT have been the same since January 2012 apart from the period from September 2020 to March 2021.

Tax-rate band increases. A high quality low cost Irish tax return service from just 185. Personal Income Tax Rate in Ireland is expected to reach 4800 percent by the end of.

Individuals aged under 70 who hold a full medical card whose aggregate income for the year is 60000 or less. Your 2021 Tax Bracket to See Whats Been Adjusted. Ireland Income Tax Brackets.

United Arab Emirates 1605.

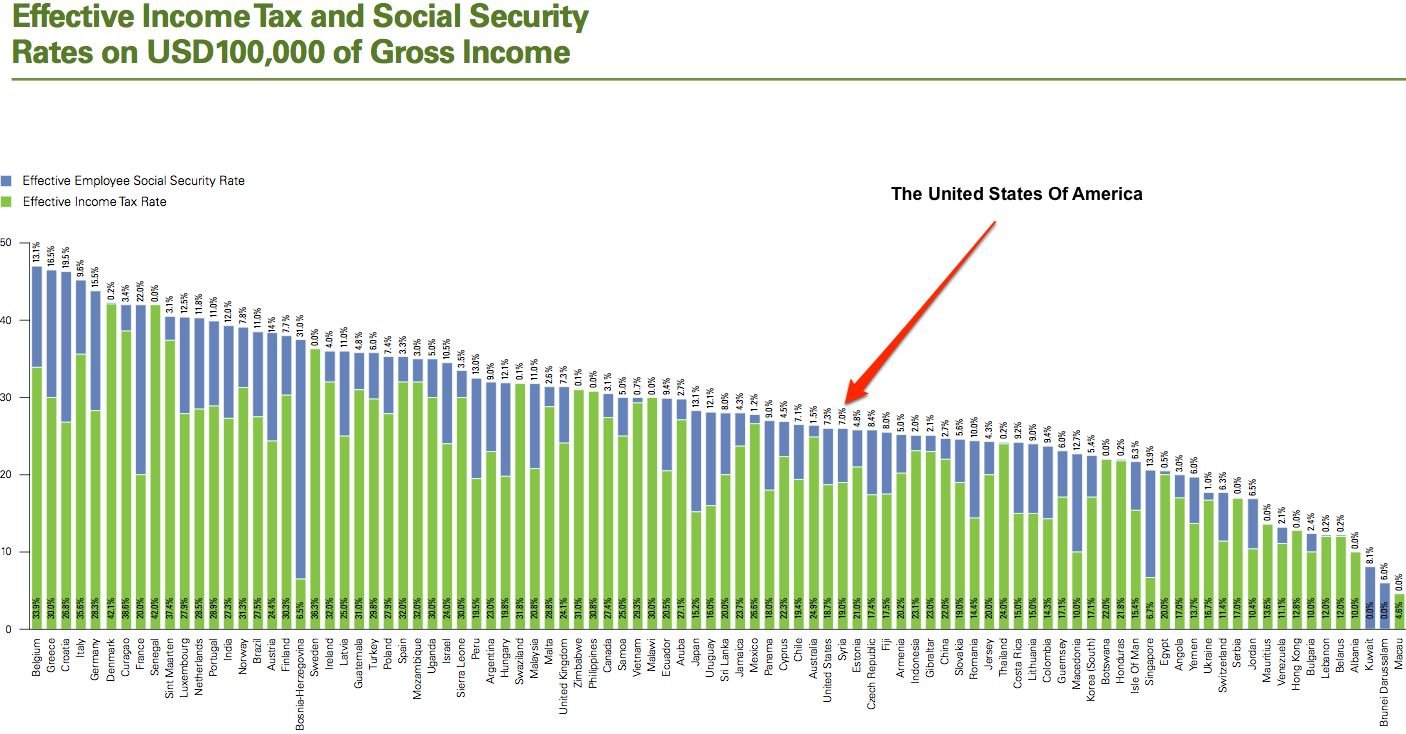

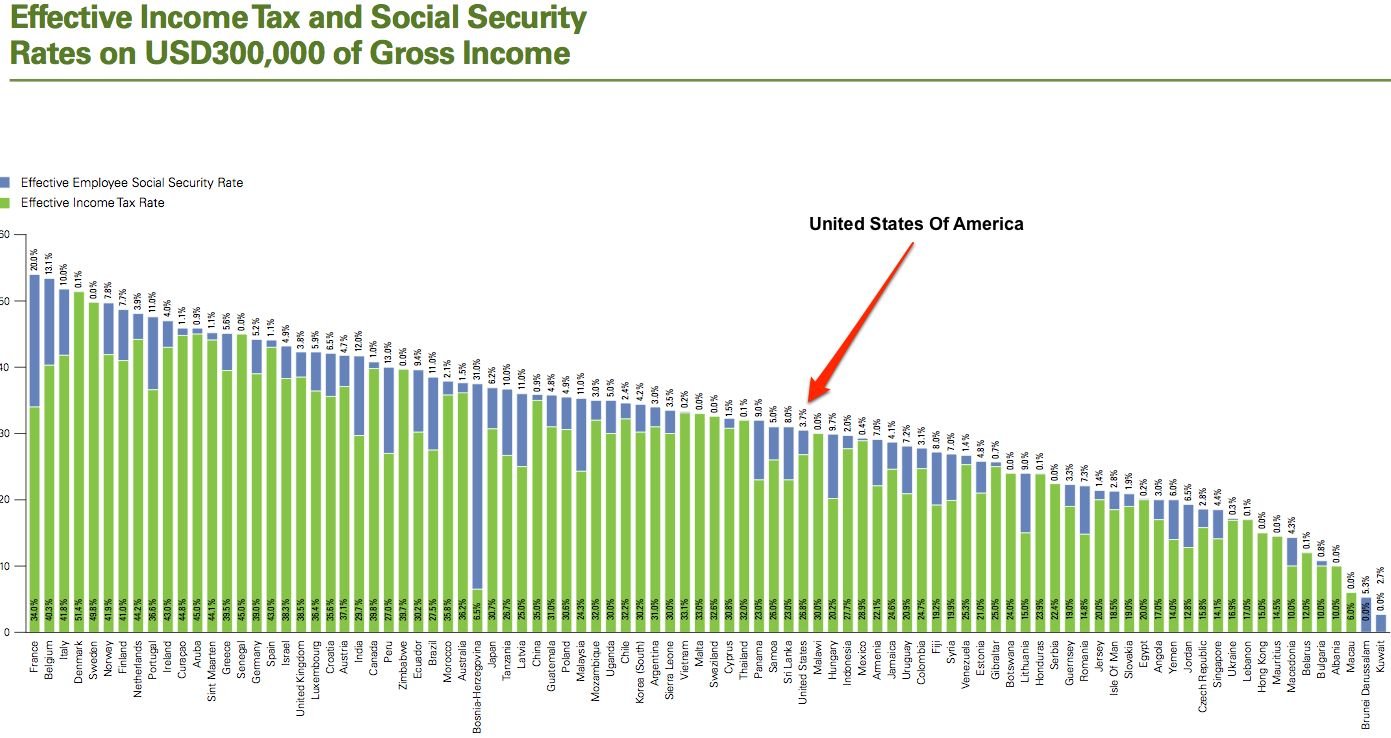

How Low Are U S Taxes Compared To Other Countries The Atlantic

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

Marginal Tax Rate Formula Definition Investinganswers

How Do Taxes Affect Income Inequality Tax Policy Center

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

How Do Taxes Affect Income Inequality Tax Policy Center

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

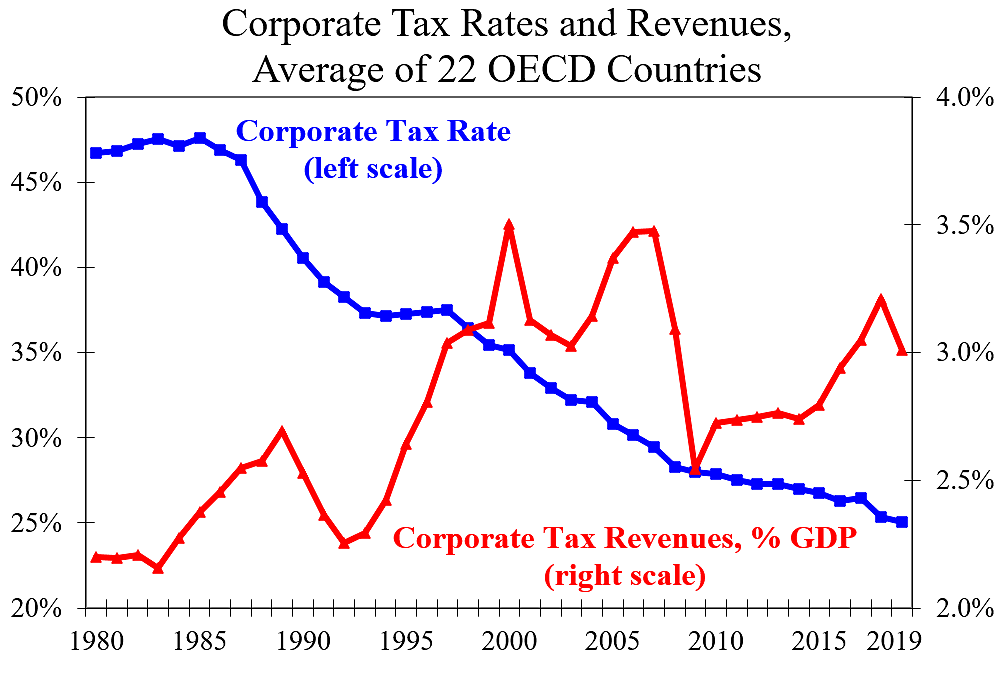

Corporate Taxes Rates Down Revenues Up Cato At Liberty Blog

Corporation Tax Europe 2021 Statista

How Low Are U S Taxes Compared To Other Countries The Atlantic

Tax Revenue Statistics Statistics Explained

Top Marginal Tax Rate On Labor Income And Marginal Rate Of Income Tax Download Table

Opinion The Rich Really Do Pay Lower Taxes Than You The New York Times

How Do Taxes Affect Income Inequality Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Poland Personal Income Tax Rate 2021 Data 2022 Forecast 1995 2020 Historical

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Another Study Confirms U S Has One Of The Highest Effective Corporate Tax Rates In The World Tax Foundation